| |

GAUSS Applications

Pre-written, customizable

GAUSS programs designed to

increase user productivity and extend GAUSS

functionality in the fields

of statistics, finance, engineering, physics,

risk analysis and more.

Algorithmic

Derivatives

|

A program for

generating GAUSS procedures for

computing algorithmic derivatives.

|

Constrained

Maximum Likelihood MT

|

Constrained Maximum

Likelihood MT provides for the

estimation of statistical models by

maximum likelihood while allowing

for the imposition of general

constraints on the parameters, linear or

nonlinear, equality or inequality, as

well as bounds.

|

| Constrained

Optimization MT |

Basic sample statistics

including means, frequencies and

crosstabs. |

| Constrained

Optimization |

Solves the nonlinear

programming problem subject to general

constraints on the parameters. |

CurveFit

|

Nonlinear curve fitting.

|

Descriptive Statistics MT

|

Basic sample statistics

including means, frequencies

and crosstabs. This application is

thread-safe and takes advantage of

structures.

|

| Discrete

Choice |

A statistical package for

estimating discrete choice

and other models in which the dependent

variable is qualitative in some

way.

|

|

FANPAC MT |

Comprehensive suite of

GARCH (Generalized AutoRegressive

Conditional Heteroskedastic) models for

estimating volatility.

|

Linear

Programming MT

|

Solves small and large

scale linear programming problems

|

Linear

Regression MT

|

Least squares estimation.

|

Loglinear

Analysis MT

|

Analysis of categorical

data using loglinear analysis.

|

Maximum

Likelihood MT

|

Maximum likelihood

estimation of the parameters of

statistical models; uses structures,

allowing calls to be safely nested

or called in threaded programs, and some

calculations are themselves

threaded.

|

Maximum Likelihood

|

Maximum

likelihood estimation of the parameters

of statistical models.

|

Nonlinear Equations MT

|

Solves

systems of nonlinear equations having as

many equations as unknowns.

|

Optimization MT

|

Unconstrained

optimization;

uses structures, allowing calls to be

safely nested or

called in threaded programs, and some

calculations are themselves

threaded.

|

Optimization

|

Unconstrained

optimization.

|

Time Series MT

|

Exact ML

estimation

of VARMAX, VARMA, ARIMAX, ARIMA, and ECM

models subject to general

constraints on the parameters. Panel

data estimation. Unit root and

cointegration tests.

|

Algorithmic Derivatives

The

GAUSS AD 1.0 module is an application program

for generating GAUSS

procedures for computing algorithmic

derivatives. A major achievement

of AD is improved accuracy for optimization.

Numerical derivatives

invariably produce a loss of precision. The

loss of precision is

greater for standard errors than it is for

estimates.

At the default tolerance, Constrained Maximum

Likelihood (CML) and

Maximum Likelihood (Maxlik) can be expected

generally to have four or

five places of accuracy, whereas standard

errors will have about two

places. Accuracy essentially doubles with AD.

AD works independently of

any application to improve derivatives, and it

can be used with any

application that uses derivatives.

For some types of optimization problems,

convergence is accelerated.

Iterations are faster and fewer of them are

needed to achieve

convergence. The types of problems that will

see the most improvement

are those with a large amount of computation.

Constrained Maximum Likelihood 2.0.6+ and

Maximum Likelihood 5.0.7+ have been updated to

improve speed with AD.

Available for Windows, LINUX, and Mac.

Requires GAUSS Mathematical and Statistical

System 6.0 or the GAUSS Engine 6.0.

Constrained Mamximum Lkelihood MT (CMLMT) i

Features

- Parameter Estimation

- Statistical Inference – Wald, Bootstrap,

Confidence Limits by Inversion

- Heteroskedastic-consistent Covariance

Matrix of Parameters

- Profile Likelihood

- Weighted Maximum Likelihood

- BFGS, DFP, Newton, BHHH descent

algorithms

- Stepbt, Brent, Half Step, Augmented

Penalty, BHHH step, Wolfe’s Line Search

Methods

- Numerical Gradient, Hessian

Provide a GAUSS procedure for computing the

log-likelihood of your statistical model, and Constrained Maximum

Likelihood MT

does the rest. Using an iterative

Sequential Quadratic

Programming method parameter estimates along

with standard errors and

confidence limits are generated.

Example

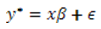

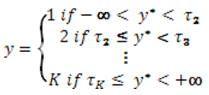

Suppose we have a dependent variable that is

observed in several

ordered categories. We might estimate

coefficients of a

regression on this variable using the ordered

probit model:

where

and

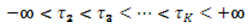

Assuming  we have we have

where where is

the Normal cumulative distribution function. where is

the Normal cumulative distribution function.

The log-likelihood function for this model is

The cmlmt

function that

performs the estimation takes four arguments,

(1) a pointer to the

procedure that computes the log-likelihood, (2)

a PV parameter

structure containing the start values of the

parameters, (3) a DS data

structure, and (4) a control structure.

GAUSS structures are simply bins containing

other objects such as

matrices, strings, arrays, etc. They can

be defined by the

programmer, but the two of the structures used

by cmlmt are defined in

the Run-Time Library, and the control structure

is defined in the cmlmt

library.

The PV

Parameter Structure

The

PV parameter structure is created and filled

using GAUSS Run-Time

Library functions. Using these functions

the structure can be

filled with vectors, matrices, and arrays

containing starting parameter

values. Masks can be used to specify fixed

versus free

parameters. For example,

struct PV p0;

// creates a default parameter structure

p0 = pvCreate;

p0 = pvPack(p0,.5|.5|.5,”beta”);

p0 = pvPackm(p0,-30|-1|1|30,”tau”,0|1|1|0);

The structure now contains starting values for a

3×1

vector of coefficients called beta,and another

4×1 vector of thresholds

called tau. It will be convenient for the

calculation of the

log-likelihood for the first and last be

parameters set to -30 and

+30. The fourth argument is a mask

specifying the first and last

elements of the vector to be fixed and the

remaining elements free

parameters to be estimated.

The DS

Data Structure

The

DS data structure is a general purpose

bucket of GAUSS types. It

contains one of each of the types, matrix,

array, string, string array,

sparse matrix, and scalar. It is

passed to the log-likelihood

procedure untouched by cmlmt. It can

be used by programmers in

any way they choose to help in computing the

log-likelihood.

Typically it is used to pass data to the

procedure. The DS

structure can also be reshaped into a vector

of structures giving the

programmer great flexibility in handling

data and other information.

load x[200,5] = data.csv;

struct DS d0;

// creates a 2x1 vector of

// default data structures

d0 = reshape(dsCreate,2,1);

// dependent variable

d0[1].dataMatrix = x[.,1];

// independent variables

d0[2].dataMatrix = x[.,2:4];

The cmlmtControl

Structure

This structure handles the matrices and

strings that

control the estimation process such as

setting the descent algorithm,

the line search method, and so on. It

is also used to specify the

constraints. For example the

thresholds need to be constrained in

the following way where . This implies

the two free constraints

The programmer will accomplish by specifing

two members of the

cmlmtControl structure, C and D, to impose

this inequality constraint

where x is the vector of parameters being

estimated. Then

struct cmlmtControl c0;

// creates a default structure

c0 = cmlmtControlCreate;

c0.C = { 0 0 0 -1 1

0,

0 0 0 0 -1 1 };

c0.D = { 0,

0 };

The first three columns of the matrix c0.C

and the vector c0.D are

associated with regression coefficients that

are unconstrained and the

last two are associated with the thresholds.

The Log-likelihood Procedure

The programmer now writes a GAUSS procedure

computing a vector of

log-likelihood probabilities. This

procedure has three input

arguments, the PV parameter structure, the

DS data structure, and 3×1

vector the first element of which is nonzero

if cmlmt is requesting the

vector of log-likelihood probabilities, the

second element nonzero if

it is requesting the matrix of first

derivatives with respect to the

parameters, and the third element nonzero if

it is requesting the

Hessian or array of second derivatives with

respect to the

parameters. It has one return

argument, a modelResults structure

containing the results.

proc orderedProbit(struct PV p, struct DS d,

ind);

local mu, tau, beta, emu, eml;

struct modelResults mm;

if ind[1] == 1;

tau =

pvUnpack(p,”tau”);

beta =

pvUnpack(p,”beta”);

mu =

d[2].dataMatrix * beta;

eml =

submat(tau,d[1].dataMatrix,0) – mu;

emu =

submat(tau,d[1].dataMatrix + 1,0) – mu;

mm.function =

ln(cdfn(emu) – cdfn(eml));

endif;

retp(mm);

endp;

The GAUSS submat function serves to pull out

the k-th element of tau for the i-th row of

d[1].datamatrix set to k.

Since this procedure doesn’t return a matrix

of first derivatives nor

an array of second derivatives they will be

computed numerically by

cmlmt.

The result stored in mm.function is an Nx1

vector of log-probabilities

computed by observation. If we were to

have provided analytical

derivatives, the first derivatives would be

an Nxm matrix of

derivatives computed by observation where m

is the number of parameters

to be estimated, and the second derivatives

would be an Nxmxm array of

second derivatives computed by

observation. Computing these

quantities in this way improves

accuracy. It also allows for the

BHHH descent method which is more accurate

than other methods

permitting a larger convergence tolerance.

It is also possible to return a scalar

log-likelihood which is the sum

of the individual log-probabilities.

In this case the analytical

first derivatives would be a 1xm gradient

vector, and the second

derivatives a 1xmxm array. You would

also need to set c0.numObs

to the number of observations since cmlmt is

no longer able to

determine the number of observations from

the length of the vector of

log-probabilities.

The Command File

Finally we put it all together in the

command file:

library cmlmt;

// contains the structure definitions

#include cmlmt.sdf;

// simulating data here

x = rndn(200,3);

b = { .4, .5, .6 };

ystar = x*b;

tau = { -50, -1, 0, 1, 50 };

y = (ystar .> tau[1] .and ystar .<=

tau[2]) +

2 * (ystar .> tau[2] .and

ystar .<= tau[3]) +

3 * (ystar .> tau[3] .and

ystar .<= tau[4]) +

4 * (ystar .> tau[4] .and

ystar .<= tau[5]);

struct DS d0;

// creates a 2x1 vector of

// default data structures

d0 = reshape(dsCreate,2,1);

// dependent variable

d0[1].dataMatrix = y;

// independent variables

d0[2].dataMatrix = x;

struct PV p0;

// creates a default parameter structure

p0 = pvCreate;

p0 = pvPack(p0,.5|.5|.5,"beta");

p0 =

pvPackm(p0,-30|-1|0|1|30,"tau",0|1|1|1|0);

struct cmlmtControl c0;

// creates a default structure

c0 = cmlmtControlCreate;

c0.C = { 0 0 0 -1 1

0,

0 0 0 0 -1 1 };

c0.D = { 0,

0};

struct cmlmtResults out;

out = cmlmt(&orderedProbit,p0,d0,c0);

// prints the results

call cmlmtprt(out);

proc orderedProbit(struct PV p, struct DS d,

ind);

local mu, tau, beta, emu, eml;

struct modelResults mm;

if ind[1] == 1;

tau =

pvUnpack(p,"tau");

beta =

pvUnpack(p,"beta");

mu =

d[2].dataMatrix * beta;

eml =

submat(tau,d[1].dataMatrix,0) - mu;

emu =

submat(tau,d[1].dataMatrix + 1,0) - mu;

mm.function =

ln(cdfn(emu) - cdfn(eml));

endif;

retp(mm);

endp;

This program produces the following output:

================================================================

CMLMT Version

2.0.7

3/30/2012 1:29 pm

=================================================================

return code = 0

normal convergence

Log-likelihood

-15.1549

Number of cases 200

Covariance of the parameters computed by the

following method:

ML covariance matrix

Parameters

Estimates Std.

err. Est./s.e.

Prob. Gradient

------------------------------------------------------------------

beta[1,1]

4.2060

0.2385

17.634

0.0000 0.0000

beta[2,1]

5.3543

0.2947

18.166

0.0000 0.0000

beta[3,1]

6.2839

0.2789

22.531

0.0000 0.0000

tau[2,1]

-10.7561

0.7437

-14.462

0.0000 0.0000

tau[3,1]

-0.0913

0.2499

-0.365

0.7148 0.0000

tau[4,1]

10.6693

0.5697

18.727

0.0000 0.0000

Correlation matrix of the parameters

1

0.52064502

0.54690534

-0.46731768

0.046211496 0.57202935

0.52064502

1

0.58363048

-0.47574225

-0.061765839 0.65959766

0.54690534

0.58363048

1

-0.5169026

-0.0059238287 0.69077806

-0.46731768

-0.47574225

-0.5169026

1

0.0046253798 -0.44858539

0.046211496 -0.061765839

-0.0059238287

0.0046253798 1

-0.01457591

0.57202935

0.65959766

0.69077806

-0.44858539

-0.01457591 1

Wald Confidence Limits

0.95 confidence limits

Parameters

Estimates Lower

Limit Upper Limit

Gradient

----------------------------------------------------------------------

beta[1,1]

4.2060

3.7355

4.6764

0.0000

beta[2,1]

5.3543

4.7730

5.9356

0.0000

beta[3,1]

6.2839

5.7338

6.8339

0.0000

tau[2,1]

-10.7561

-12.2230

-9.2893

0.0000

tau[3,1]

-0.0913

-0.5842

0.4015

0.0000

tau[4,1]

10.6693

9.5457

11.7929

0.0000

Number of iterations 135

Minutes to

convergence 0.00395

Constrained Optimization MT (COMT)

solves the Nonlinear Programming problem,

subject to general

constraints on the parameters – linear or

nonlinear, equality or

inequality, using the Sequential Quadratic

Programming method in

combination with several descent methods

selectable by the user:

- Newton-Raphson

- quasi-Newton (BFGS and DFP)

- Scaled quasi-Newton

There

are also several selectable line search

methods. A Trust Region method

is also available which prevents saddle

point solutions. Gradients can

be user-provided or numerically calculated.

COMT is fast and can handle

large, time-consuming problems because it

takes advantage of the speed

and number-crunching capabilities of GAUSS.

It is thus ideal for large

scale Monte Carlo or bootstrap simulations.

New

Features

- Internally threaded functions

- Uses structures

- Improved algorithm

- Allows for computing a subset of the

derivatives

analytically, and for combining the

calculation of the function and

derivatives, thus reducing calculations

in common between function and

derivatives

Threading

in COMT

If you have a multi-core processor you may

take advantage of COMT’s

internally threaded functions. An important

advantage of threading

occurs in computing numerical derivatives.

If the derivatives are

computed numerically, threading will

significantly decrease the time of

computation.

Example

We

ran a time trial of a covariance-structure

model on a quad-core

machine. As is the case for most real world

problems, not all sections

of the code are able to be run in parallel.

Therefore, the theoretical

limit for speed increase is much less than

(single-threaded execution

time)/(number of cores).

Even so, the execution time of our program

was cut dramatically:

Single-threaded execution time: 35.42

minutes

Multi-threaded execution time: 11.79 minutes

That is a nearly 300% speed increase!

The DS

Structure

COMT uses the DS and PV structures that

are available in the GAUSS Run-Time

Library.

The DS structure is completely

flexible, allowing

you to pass anything you can think of into

your procedure. There is a

member of the structure for every GAUSS data

type.

struct DS {

scalar type;

matrix dataMatrix;

array dataArray;

string dname;

string array vnames;

};

The PV

Structure

The PV structure revolutionizes how

you pass the

parameters into the procedure. No longer do

you have to struggle to get

the parameter vector into matrices for

calculating the function and its

derivatives, trying to remember, or figure

out, which parameter is

where in the vector.

If your log-likelihood uses matrices or

arrays,you can store them

directly into the PV structure and remove

them as matrices or arrays

with the parameters already plugged into

them. The PV structure can

handle matrices and arrays in which some of

their elements are fixed

and some free. It remembers the fixed

parameters and knows where to

plug in the current values of the free

parameters. It can also handle

symmetric matrices in which parameters below

the diagonal are repeated

above the diagonal.

b0 – Mean paramters.

garch – GARCH parameters.

arch – ARCH parameters.

omega – Constant in variance equation.

There is no longer any need to use global

variables. Anything the

procedure needs can be passed into it

through the DS structure. And

these new applications uses control

structures rather than global

variables. This means, in addition to thread

safety, that it is

straightforward to nest calls to COMT inside

of a call to COMT,

QNewtonmt, QProgmt, or EQsolvemt.

Available for Windows, Mac,

Linux and Solaris. Requires GAUSS/GAUSS

Light version 10 or higher.

Constrained Optimization (CO)

CO is an applications module

written in the GAUSS programming language.

It solves the Nonlinear Programming problem,

subject to general

constraints on the parameters - linear or

nonlinear, equality or

inequality, using the Sequential Quadratic

Programming method in

combination with several descent methods

selectable by the user -

Newton-Raphson, quasi-Newton (BFGS and DFP), and

scaled quasi-Newton.

There are also several selectable line search

methods. A Trust Region

method is also available which prevents saddle

point solutions.

Gradients can be user-provided or numerically

calculated.

CO is fast and can handle large, time-consuming

problems because it

takes advantage of the speed and

number-crunching capabilities of

GAUSS. It is thus ideal for large scale Monte

Carlo or bootstrap

simulations.

Example

A Markowitz mean/variance portfolio allocation

analysis on a thousand

or more securities would be an example of a

large scale problem CO

could handle.

CO also contains a special technique for

semi-definite problems, and

thus it will solve the Markowitz portfolio

allocation problem for a

thousand stocks even when the covariance matrix

is computed on fewer

observations than there are securities.

Because CO handles general nonlinear functions

and constraints, it can

solve a more general problem than the Markowitz

problem. The efficient

frontier is essentially a quadratic programming

problem where the

Markowitz Mean/Variance portfolio allocation

model is solved for a

range of expected portfolio returns which are

then plotted against the

portfolio risk measured as the standard

deviation:

where l is a conformable vector of ones, and

where  is the observed

covariance matrix of the returns of a portfolio

of securities, and µ are their observed means. is the observed

covariance matrix of the returns of a portfolio

of securities, and µ are their observed means.

This model is solved for

and the efficient frontier is the plot of rk

on the vertical axis against

on the horizontal axis. The portfolio weights in

Wk describe

the optimum distribution of portfolio resources

across the securities

given the amount of risk to return one considers

reasonable.

Because of CO's ability to handle nonlinear

constraints, more elaborate

models may be considered. For example, this

model frequently

concentrates the allocation into a minority of

the securities. To

spread out the allocation one could solve the

problem subject to a

maximum variance for the weights, i.e., subject

to

where  is a

constant setting a ceiling on the sums of

squares of the weights. is a

constant setting a ceiling on the sums of

squares of the weights.

correlation matrix

This data was taken from from Harry S. Marmer

and F.K. Louis Ng,

"Mean-Semivariance Analysis of Option-Based

Strategies: A Total Asset

Mix Perspective", Financial Analysts Journal,

May-June 1993.

An unconstrained analysis produced the results

below:

It can be observed that the optimal portfolio

weights are highly concentrated in T-bills.

Now let us constrain w´w to be less than, say,

.8. We then get:

The constraint does indeed spread out the

weights across the categories, in particular

stocks seem to receive more emphasis.

Efficient

portfolio for these analyses

We see there that the constrained

portfolio is

riskier everywhere than the unconstrained

portfolio given a particular

portfolio return.

In summary, CO is well-suited for a variety of

financial applications

from the ordinary to the highly sophisticated,

and the speed of GAUSS

makes large and time-consuming problems

feasible.

CO is an advanced GAUSS Application and comes as

GAUSS source code.

GAUSS Applications are modules written in GAUSS

for performing specific

modeling and analysis tasks. They are designed

to minimize or eliminate

the need for user programming while maintaining

flexibility for

non-standard problems.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

CurveFit

Given data and a procedure for computing the

function, CurveFit will

find a best fit of the data to the function in

the least squares sense.

Special Features

- Weight observations

- Multiple dependent variables

- Bootstrap estimation

- Histogram and surface plots of

bootstrapped coefficients

- Profile t, and profile likelihood trace

plots

- Levenberg-Marquardt descent method

- Polak-Ribiere conjugate gradient descent

method

- Ability to activate and inactivate

coefficients

- Heteroskedastic-consistent covariance

matrix of coefficients

Bootstrap Estimation

CurveFit includes special

procedures for computing

bootstrapped estimates. One procedure produces

a mean vector and

covariance matrix of the bootstrapped

coefficients. Another generates

histogram plots of the distribution of the

coefficients and surface

plots of the parameters in pairs. The plots

are especially valuable for

nonlinear models because the distributions of

the coefficients may not

be unimodal or symmetric.

Profile t, and Profile Likelihood Trace

Plots

Also included in the module

is a procedure that

generates profile t trace plots and profile

likelihood trace plots

using methods described in Bates and Watts,

"Nonlinear Regression

Analysis and its Applications". Ordinary

statistical inference can be

very misleading in nonlinear models. These

plots are superior to usual

methods in assessing the statistical

significance of coefficients in

nonlinear models.

Descent Methods

The primary

descent

method for the single dependent variable is

the classical

Levenberg-Marquardt method. This method

takes advantage of the

structure of the nonlinear least squares

problem, providing a robust

and swift means for convergence to the

minimum. If, however, the model

contains a large number of coefficients to

be estimated, this method

can be burdensome because of the requirement

for storing and computing

the information matrix. For such models the

Polak-Ribiere version of

the conjugate gradient method is provided,

which does not require the

storage or computation of this matrix.

Multiple Dependent Variables

CurveFit allows multiple

dependent variables using a

criterion function permitting the

interpretation of the estimated

coefficients as either maximum likelihood

estimates or as Bayesian

estimates with a noninformative prior. This

feature is useful for

estimating the parameters of "compartment"

models, i.e., models arising

from linear first order differential

equations.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Descriptive

Statistics (MT 1.0)

The procedures in Descriptive

Statistics MT 1.0

provide basic statistics for the variables in

GAUSS data sets. These

statistics describe and test univariate and

multivariate features of

the data and provide information for further

analysis. Descriptive

Statistics MT 1.0 is a new product

that is thread-safe and takes advantage of

structures.

- Includes methods for analyzing and

generating contingency

tables and statistics for them.

- Includes new routines to compute

descriptive statistics,

including both univariate and multivariate

skew and kurtosis.

- Includes support for variable names of up

to 32 characters.

- Includes support for date variables where

applicable.

- You can now choose between two report

types-all variables

in a single table or individual reports for

each variable-and

you can choose which statistics to include

in the report and

the order in which they appear.

Descriptive Statistics MT 1.0 has methods for

analyzing and generating contingency tables and

producing statistics for them:

- Chi-Squared (Pearson and Likelihood Ratio)

- Phi

- Cramer's V

- Spearman s Rho

- Goodman-Krustal's Gamma Kendall's Tau-B

Stuart s Tau-C Somer's D

- Lamda

Descriptive Statistics MT 1.0 also has methods

for generating frequency

distributions with statistics, skew and

kurtosis, and tests for

differences of means.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Discrete

Choice is a package for the fitting

of a variety of models

with categorical dependent variables. These

models are particularly

useful for researchers in the social,

behavioral, and biomedical

sciences, as well as economics, public choice,

education, and marketing.

Output for these models includes full

information maximum likelihood

estimates with either standard and

quasi-maximum likelihood inference.

In addition, estimates of marginal effects are

computed either as

partials of the probabilities with respect to

the means of the

exogenous variables or optionally as the

average partials of the

probabilities with respect to the exogenous

variables.

Models

Nested logit

model

- Is derived from the assumption that

residuals have a

generalized extreme value distribution and

allows for a general pattern

of dependence among the responses thus

avoiding the IIA problem, i.e.,

the "independence of irrelevant

alternatives."

Conditional logit model

- Includes both variables that are

attributes of the

responses as well as, optionally, exogenous

variables that are

properties of cases.

Multinomial logit model

- Qualitative responses are each modeled

with a separate set of regression

coefficients

Adjacent category multinomial logit model

- The log-odds of one category versus the

next higher category is linear in the

cutpoints and explanatory variables

Stereotype multinomial logit model

- The coefficients of the regression in each

category are linear functions of a reference

regression

Poisson regression, left or right truncated,

left or right censored, or zero-inflated

models

- Estimates model with Poisson distributed

dependent

variable. This includes censored models -

the dependent variable is not

observed but independent variables are

available - and truncated models

where not even the independent variables are

observed. Also, a

zero-inflated Poisson model can be estimated

where the probability of

the zero category is a mixture of a Poisson

consistent probability and

an excess probability. The mixture

coefficient can be a function of

independent variables.

Negative binomial regression, left or right

truncated, left or right censored, or

zero-inflated models

- Estimates model with negative binomial

distributed

dependent variable. This includes censored

models - the dependent

variable is not observed but independent

variables are available - and

truncated models where not even the

independent variables are observed.

Also, a zero-inflated negative binomial

model can be estimated where

the probability of the zero category is a

mixture of a negative

binomial consistent probability and an

excess probability. The mixture

coefficient can be a function of independent

variables.

Logit, probit models

- Estimates dichotomous dependent variable

with either Normal or extreme value

distributions

Ordered logit, probit models

- Estimates model with an ordered

qualitative dependent variable with Normal

or extreme value distributions

Available

for Windows, Mac, Linux and Solaris.

Requires GAUSS/GAUSS Light version 8.0 or

higher.

FANPAC MT 3.0

FANPAC

MT is a set of threadsafe keyword commands and

procedures for the

econometric analysis of financial data. More

specifically, the

estimation of parameters of time series models

via the maximum

likelihood method. The package is divided into

two parts:

The package

is divided into two parts:

- Easy-to-program keyword commands which

simplify the modeling process

- GAUSS procedures, which can be called

directly to perform the computations,

allowing for great flexibility

New features

FANPAC MT 3.0 gives econometricians and

financial professionals access

to many new multivariate models, which provide a

better fit for some

financial problems. New models/features are

listed in orange.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Linear Programming MT

Linear

Programming MT Module solves the standard

linear programming problem with the following

NEW and CUTTING-EDGE features:

- Thread-safe

Execution: Control

variables are model matrices are contained

in structures allowing

thread-safe execution of programs.

- Sparse

matrices: Linear Programming MT

exploits sparse matrix technology permitting

the analysis of problems

with very large constraint matrices. The

size of a problem that can be

analyzed is dependent on the speed and

amount of memory on the

computer, but problems with two to three

thousand constraints and more

than six thousand variables have been tested

on ordinary PC's.

- MPS files:

procedures are available for translating MPS

formatted files.

Other Product Features

LPMT is

designed to solve

small and large scale linear programming

problems. LPMT can be

initialized with a starting value, such as the

solution to a previous

problem which is similar to the one being

solved. This feature can

dramatically reduce the number of iterations

required to find a

feasible starting point.

Features

- Upper and lower finite bounds can be

provided for variables and constraints

- Problem type (minimization or

maximization)

- Constraint types (<=, >=, =)

- Choice of tolerances

- Pivoting rules

Computes

- The value of the variables and the

objective function upon termination, and

returns the dual variables

- State of each constraint

- Uniqueness and quality of solution

- Multiple optimal solutions if they exist

- Number of iterations required

- A final basis

- Can generate iterations log and/or final

report, if requested

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Linear Regression MT

The Linear Regression MT

application module is a set

of procedures for estimating single equations

or a simultaneous system

of equations. It allows constraints on

coefficients, calculates het-con

standard errors, and includes two-stage least

squares, three-stage

least squares, and seemingly unrelated

regression. It is thread-safe

and takes advantage of structures found in

later versions of

GAUSS.

Features

- Calculates heteroskedastic-consistent

standard errors, and performs

both influence and collinearity diagnostics

inside the ordinary least

squares routine (OLS)

- All regression procedures can be run at a

specified data range

- Performs multiple linear hypothesis

testing with any form

- Estimates regressions with linear

restrictions

- Accommodates large data sets with

multiple variables

- Stores all important test statistics and

estimated coefficients in an efficient

manner

- Both three-stage least squares and

seemingly unrelated regression can be

estimated iteratively

- Thorough Documentation

- The comprehensive user's guide includes

both a

well-written tutorial and an informative

reference section. Additional

topics are included to enrich the usage of

the procedures. These

include:

- Joint confidence region for beta

estimates

- Tests for heteroskedasticity

- Tests of structural change

- Using ordinary least squares to estimate

a translog cost function

- Using seemingly unrelated regression to

estimate a system of cost share equations

- Using three-stage least squares to

estimate Klein's Model I

Available

for Windows, Mac, Linux and Solaris.

Requires GAUSS/GAUSS Light version 8.0 or

higher.

Loglinear Analysis MT

The Loglinear

Analysis MT

application module (LOGLIN) contains

procedures for the analysis of

categorical data using loglinear analysis.

This application is

thread-safe and takes advantage of structures.

The estimation is based on the assumption that

the cells of the K-way

table are independent Poisson random

variables. The parameters are

found by applying the Newton-Raphson method

using an algorithm found in

A. Agresti (1984) Analysis of Ordinal

Categorical Data.

You may construct your own design matrix or

use LOGLIN procedures to

compute one for you. You may also select the

type of constraint and the

parameters.

Features

- Fits a

hierarchical model given fit configurations

- Will fit all

3-way hierarchical models of a table

- Provides for

cell weights

- LOGLIN can

estimate most

of the models described in such texts as

Y.M.M. Bishop, S.E. Fienberg,

and P.W. Holland (1975) Discrete

Multivariate Analysis, S. Haberman

(1979) Analysis of Qualitative Data, Vols. 1

and 2, as well as the book

by A. Agresti.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Maximum Likelihood (MaxlikMT) MT 2.0

MaxlikMT 2.0 contains a set

of procedures for the solution of the maximum

likelihood problem with bounds on parameters.

Major

Features of MaxLikMT

- Structures

- Simple bounds

- Hypothesis testing for models with bounded

parameters

- Log-likelihood function

- AlgorithmSecant algorithms

- Line search methods

- Weighted maximum likelihood

- Active and inactive parameters

- Bounds

In MaxlikMT,

the same

procedure computing the log-likelihood or

objective function will be

used to compute analytical derivatives as well

if they are being

provided. Its return argument is a

maxlikmtResults structure with three

members, a scalar, or Nx1 vector containing

the log-likelihood (or

objective), a 1xK vector, or NxK matrix of

first derivatives, and a KxK

matrix or NxKxK array of second derivatives

(it needs to be an array if

the log-likelihood is weighted).

Of course the derivatives are optional, or

even partially optional,

i.e., you can compute a subset of the

derivatives if you like and the

remaining will be computed numerically. This

procedure will have an

additional argument which tells the function

which to compute, the

log-likelihood or objective, the first

derivatives, or the second

derivatives, or all three. This means that

calculations in common will

not have to be redone.

Available for

Windows, Mac, Linux

and Solaris. Requires GAUSS/GAUSS Light

version 10 or higher; Linux

requires version 10.0.4 or higher.

Maximum

Likelihood (MAXLIK)

MAXLIK

performs maximum

likelihood estimation of the parameters of

statistical models. All you

provide is a GAUSS function to calculate the

log-likelihood for a set

of observations. MAXLIK does the rest.

Major Features

of Maximum Likelihood

- More than 25

user-selectable options control the

optimization

- Fast

Procedures: FASTMAX, FASTBoot, FASTBayes,

FASTProfile, and FASTPflCLimits

can speed convergence times up to 800

percent over earlier versions of MAXLIK,

depending on the type of problem.

- "Kiss-Monster"

random numbers used in the bootstrap

procedure and random line search algorithm.

- The bootstrap

and random line search procedures use

the new "Kiss-Monster" random number

generator. It has a period of

10^8859, long enough for serious Monte Carlo

work.

- Descent

algorithms include: BFGS

(Broyden-Fletcher-Goldfarb-Shanno), DFP

(Davidon-Fletcher-Powell),

Newton, steepest descent, PRCG

(Polak-Ribiere-type conjugate gradient),

and BHHH (Berndt-Hall-Hall-Hausman)

- Step-length

methods include: STEPBT, BRENT, BHHHSTEP,

and a step-halving method

- A "switching"

method may also be selected which

switches the algorithm during the iterations

according to three

criteria: number of iterations, failure of

the function to decrease

within a tolerance, or decrease of the line

search step length below a

tolerance

Improved

Algorithm

MAXLIK

implements the

Cholesky factorization, solve, and update

methods for the BFGS, DFP,

and Newton algorithms. Event Count and

Duration Regression

An included COUNT module (by Gary King,

Harvard University) estimates

limited dependent variable models. These

procedures provide maximum

likelihood estimator s for parametric

regression models of events data,

i.e., models with dependent variables that are

measured either as event

counts or as durations between events.

Available

for Windows, Mac, Linux and Solaris.

Requires GAUSS/GAUSS Light version 8.0 or

higher.

Nonlinear Equations MT

The Nonlinear

Equations

MT applications module (NLSYS) solves systems

of nonlinear equations

where there are as many equations as unknowns.

This application is

thread-safe and takes advantage of structures

found in later versions

of GAUSS.

The functions must be continuous and

differentiable. You may provide a

function for calculating the Jacobian, if

desired. Otherwise NLSYS will

compute the Jacobian numerically. You can also

select from two descent

algorithms, the Newton method or the secant

update method, and from two

step-length methods, a quadratic/cubic method,

or the hookstep method.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Optimization MT (OPMT) 1.0

OPMT is intended for the

optimization of functions.

It has many features, including a wide

selection of descent algorithms,

step-length methods, and "on-the-fly"

algorithm switching. Default

selections permit you to use Optimization with

a minimum of programming

effort. All you provide is the function to be

optimized and start

values, and OPMT does the rest.

Special Features in Optimization MT 1.0

-

Internally threaded.

-

Uses structures.

-

Allows for placing bounds on the

parameters.

-

Allows for computing a subset of the

derivatives

analytically, and for combining the

calculation of the function and

derivatives, thus reducing calculations in

common between function and

derivatives.

- More than 25 options can be easily

specified by the user to control the

optimization

- Descent algorithms include: BFGS, DFP,

Newton, steepest descent, and PRCG

- Step length methods include: STEPBT,

BRENT, and a step-halving method

- A "switching" method may also be selected

which

switches the algorithm during the iterations

according to two criteria:

number of iterations, or failure of the

function to decrease within a

tolerance

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

10 or higher.

Optimization

Optimization

is intended

for the optimization of functions. It has many

features, including a

wide selection of descent algorithms,

step-length methods, and

"on-the-fly" algorithm switching. Default

selections permit you to use

Optimization with a minimum of programming

effort. All you provide is

the function to be optimized and start values,

and Optimization does

the rest.

Features

- More than 25 options can be easily

specified by the user to control the

optimization

- Descent algorithms include: BFGS, DFP,

Newton, steepest descent, and PRCG

- Step length methods include: STEPBT,

BRENT, and a step-halving method

- A "switching" method may also be selected

which

switches the algorithm during the iterations

according to two criteria:

number of iterations, or failure of the

function to decrease within a

tolerance

Improved

Algorithm

Optimization

implements

the numerically superior Cholesky

factorization, solve and update

methods for the BFGS, DFP, and Newton

algorithms. The Hessian, or its

estimate, are updated rather than the inverse

of the Hessian, and the

descent is computed using a solve. This

results in better accuracy and

improved convergence over previous methods.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light version

8.0 or higher.

Time Series MT 1.0

Time Series MT

1.0 is the newest time

series application available for GAUSS. This

new product will

streamline the creation of large GAUSS

programs that utilize Time

Series models.

Features

-

LSDV - Least Squares

Dummy Variable model for multivariate data

with bias correction of the parameters

-

Switch - Hamilton's

Regime-Switching Regression model

-

SVARMAX - Seasonal VARMAX model:

SVARMAX(p,d,q,P,D,Q)s

- TSCS - Time Series Cross-Sectional

Regression models

Autoregressive Models

- Computes estimates of the parameters and

standard errors for a regression model with

autoregressive errors.

Matrices

- Portmanteau Statistics

- Forecasting: Univariate and Multivariate

- Univariate Simulation

Switching

Regression

- Bayesian prior

- Constraints on transition probabilities

Additional

Features

- Exact full information maximum likelihood

(FIML) estimation of VARMAX and VARMA,

ARIMAX, ARIMA, ECM models.

- Impose general linear and nonlinear and

equality

and inequality constraints on the

parameters. Find Lagrangean values

associated with each constraint. Return

ACF indicator matrices,

together with other summary information,

including Akaike, Schwarz, and

Bayesian information criteria. Compute

forecasts from VARMAX and VARMA

models.

- Exact maximum likelihood estimation of ECM

models.

- Unit root and cointegration tests, DF,

ADF, Phillips-Perron, and Johansen's Trace

and Maximum Eigenvalue tests.

- Estimation of VAR models.

- Compute parameter estimates and standard

errors for

a regression model with autoregressive

errors. Can be used for models

for which the Cochrane-Orcutt or similar

procedures are used. Also

computes autocovariances and

autocorrelations of the error term.

- ARIMA Models

- The Time Series module includes tools

for

estimating general ARIMA (p,d,q) models

using an exact MLE procedure

based on C. Ansley (Biometrika 1979, pp.

59-65). Procedures for

computing forecasts, theoretical

autocovariances, sample

autocorrelations, and partial

autocorrelations (using Durbin's

algorithm), as well as for simulating

ARIMA models are provided.

- Time-Series Cross-Sectional Regression

Models: TSCS

- This module provides procedures to

compute

estimates for "pooled time-series

cross-sectional" models. The

assumption is that there are multiple

observations over time on a set

of cross-sectional units (e.g., people,

firms, countries).

For example, the analyst may have data for

a cross-section of

individuals each measured over 10 time

periods. While these models were

devised to study a cross-section of units

over multiple time periods,

they also correspond to models in which

there are data for groups such

as schools or firms with measurements on

multiple observations within

the group (e.g., students, teachers,

employees).

The specific model that can be estimated

with this program is a

regression model with variable intercepts.

That is, a model with

individual-specific effects. The

regression parameters for the

exogenous variables are assumed to be

constant across cross-sectional

units. The intercept varies across

individuals. This program provides

three estimators:

- Fixed-effects OLS estimator (analysis

of covariance estimator)

- Constrained OLS estimator

- Random effects estimator using GLS

A

Hausman test is computed to show whether the

error components (random

effects)

model is the correct specification. In addition

to providing

the

analysis

of computed. The first partial squared

correlation shows the

percentage

of variation in the dependent variable that can

be explained

by

the

set of independent variables while holding

constant the group

variables.

The

second shows the extent to which variation in

the dependent

variable can

be

accounted for by the group variable after the

other independent

variables

have

been statistically held constant.

A key feature of this program is that it

allows for a variable number of

time-series

observations per cross-sectional unit. For

instance, there

might be 5

time-series observations for the first

individual, 10 for the

second, and so on. This is useful when there

are missing values.

Available for Windows, Mac, Linux and

Solaris. Requires GAUSS/GAUSS Light

version 8.0 or higher.

© Copyright 2004-2013

Aptech Systems, Inc.

|

|